The all-in-one mortgage platform, built to scale with you.

From our AI-powered LOS to built-in compliance and lender access — Morty brings every part of your mortgage business together in one modern system.

- 0s

- Loan options in PPE

- Real-time pricing and eligibility across 25+ lenders.

- 0x

- Faster document processing

- AI parses documents and auto-generates conditions in real time.

- 0/5

- Borrower satisfaction

- High-converting digital experience with branded POS.

- 0B+

- Loan volume supported

- Trusted by hundreds of teams nationwide.

Explore the Morty platform

Modular tools, fully integrated. Choose what you need — or get everything out of the box.

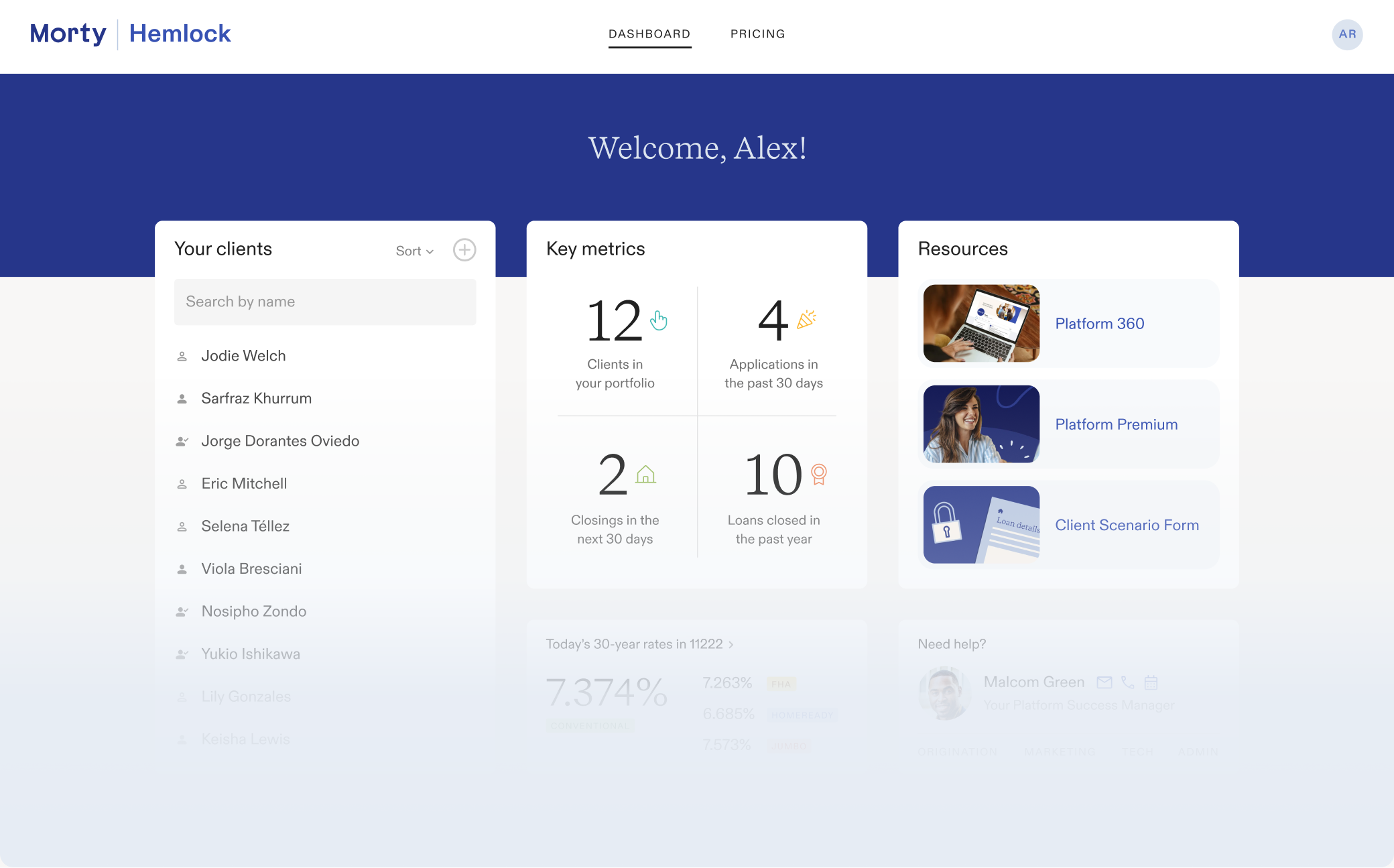

Loan Origination System

Manage clients, pipelines, and workflows in one centralized platform — complete with automation, reporting, and compliance oversight.

Point-of-Sale

Give borrowers a seamless digital experience with branded intake, automated pre-approvals, and real-time updates.

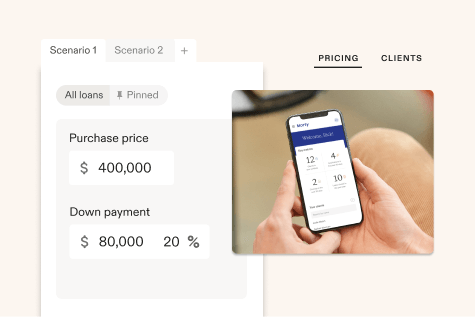

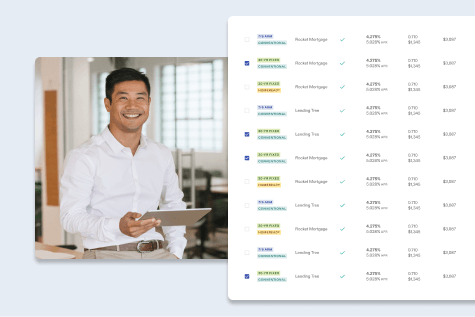

Pricing Engine

Surface thousands of loan options in real time with built-in eligibility filters and customizable overlays across 25+ lenders.

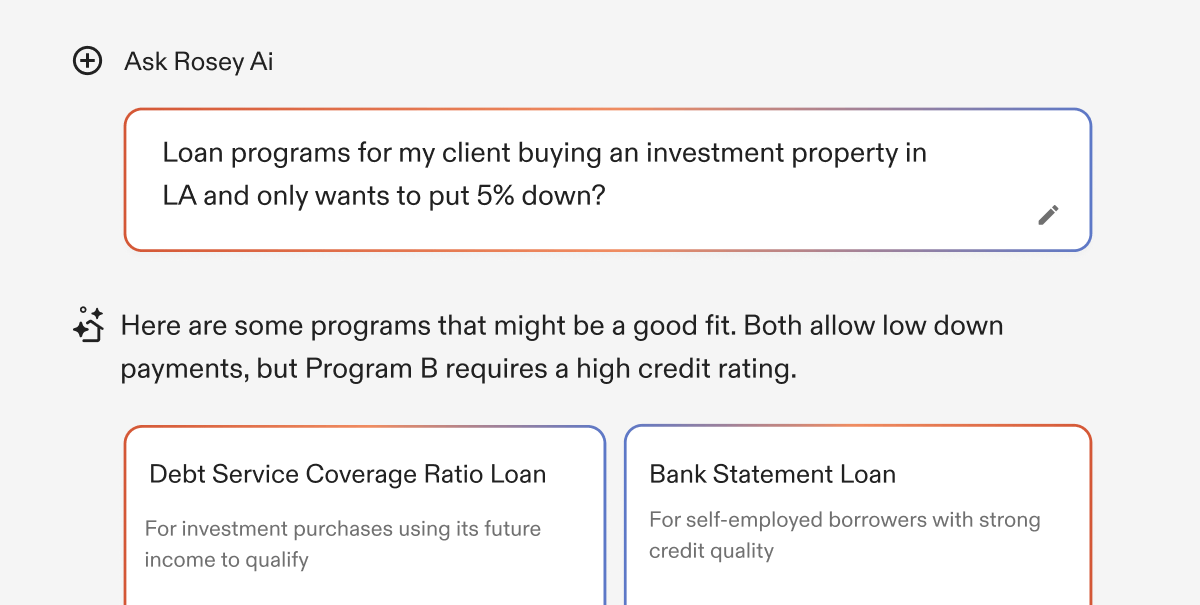

Rosey AI

Accelerate document review and condition setup with AI that parses loan files and automates critical workflows.

Lender Network

Access 25+ lenders with integrated pricing, eligibility, and product overlays — all in one connected platform.

Compliance Infrastructure

Support multi-state licensing, disclosures, and audit tracking with built-in compliance tools and oversight workflows.

Processing & Fulfillment Support

Tap into dedicated support pods and automation tools that streamline fulfillment from application through closing.

Brand Tools & Marketing Website

Create a fully branded digital storefront with templates, domain management, and customizable content.

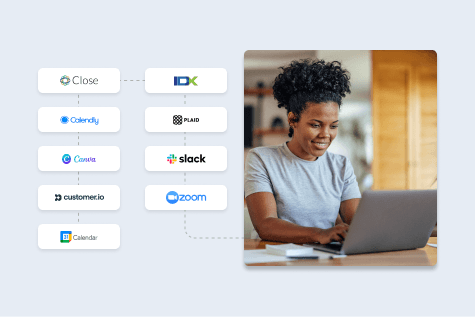

Data & Integrations

Connect your Morty data with third-party tools — from credit and CRM systems to analytics and custom workflows.

Ready to dive in?

Start your free trial today.

“In finance—whether it’s banking, financial advising, or mortgages—people just need clear explanations. The ability to get quick, accurate insights is critical. A DTI issue shouldn’t take days to figure out—it should take an hour, or even minutes.”

Let AI handle the tedious work while you build relationships

Morty's Rosey AI automates document review, verifies assets instantly, and handles routine tasks—reducing processing time by 75% and eliminating human error.

Feature comparison

| Feature | Morty tier | Do it yourself tier |

|---|---|---|

| Pricing Engine | | $99/mo $99/mo |

| Loan Origination System | | $199/mo $199/mo |

| Point of Sales | | $199/mo $199/mo |

| Processing & Fulfillment | | X X |

| Training & Onboarding | | X X |

| Brand Builder | | X X |

| Resource Center | | X X |

| Email & web hosting | | $59/mo $59/mo |